pay indiana estimated taxes online

If you do not have your voucher visit our Electronic Payment Vouchers page to create one. Know when I will receive my tax refund.

Indiana Dept Of Revenue Inrevenue Twitter

If you file your income tax return on paper enclose a check with your return.

. Cookies are required to use this site. Mail entire form and payment to. Will not have Indiana tax withheld or If you think the amount withheld will not be enough.

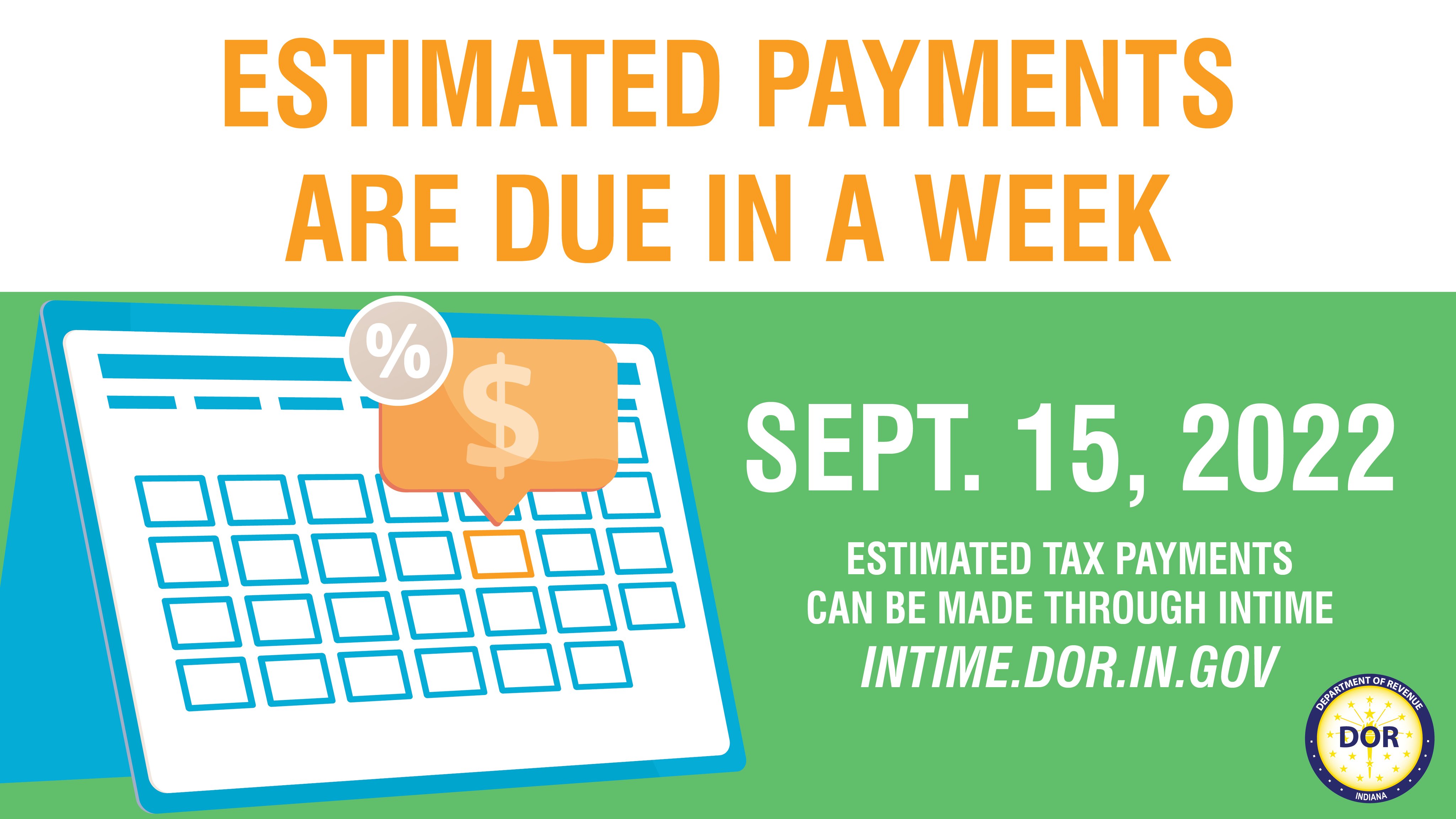

INTIME provides access to manage and pay. Many corporate and individual tax customers are getting ready to make the first payment of their quarterly estimated taxes to the Indiana Department of Revenue DOR due April 18 2022. To determine if these changes will affect your 2021 estimated tax payments see Estimated tax law changesIf you need to adjust already-scheduled payments due to the new brackets and rates you may cancel and resubmit.

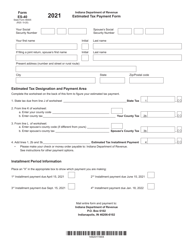

State Form 46005 R20 9. Never paid estimated tax andor filed an annual Indiana. The 2021-2022 New York State budget replaced the highest personal income tax bracket and rate for 2021 with three new brackets and rates.

Payment can be made by credit or debit card Discover Visa MasterCard or American Express using the departments Online Services Guest Payment Service directly visiting ACI Payments. The estimated income tax payment and Form E-6 and IT-6 are due on April 20 June 20 Sept. Vehicle use tax bills RUT series tax forms must be paid by check.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Your browser appears to have cookies disabled. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

20 of the tax year if filing. Lines J K and L If you are paying only the. View the amount you owe your payment plan details payment history and any scheduled or pending payments.

Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. To make an estimated tax payment online log on to DORs e-services portal the Indiana Taxpayer. Know when I will receive my tax refund.

The Indiana Taxpayer Information Management Engine known as INTIME is the Indiana Department of Revenues DOR e-services portal. You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. Indiana Department of Revenue.

Know when I will receive my tax refund. Check or money order follow the payment instructions on the form or voucher associated with your filing ACH Credit - ACH credit is NOT the preferred payment option for most taxpayers. If you do not enclose a check a bill will be sent to you after the return has been processed.

Select the Make a Payment link under the. Access INTIME at intimedoringov. If you dont already have a MyTax Illinois account click here.

Find Indiana tax forms. Find Indiana tax forms. To make an individual estimated tax payment electronically without logging in to INTIME.

For individuals only. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business. Make a same day payment from your bank account for your balance payment plan estimated tax.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Find Indiana tax forms. Line I This is your estimated tax installment payment.

Box 6102 Indianapolis IN 46206-6102. Estimated Tax Payment Form. How To Pay Estimated Taxes.

Indiana Income Tax Calculator Smartasset

Indiana Income Tax Calculator Smartasset

Some Irs Online Services Including Ways To Pay Estimated Taxes Are Working Despite Shutdown Don T Mess With Taxes

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Hoosiers Get Another Month To File Pay 2020 Indiana Taxes Wthr Com

Indiana Sales Tax Rate Rates Calculator Avalara

Estimated Quarterly Tax Payments 1040 Es Guide Dates

Dor Make Estimated Tax Payments Electronically

Llc Tax Calculator Definitive Small Business Tax Estimator

Indiana Dept Of Revenue Inrevenue Twitter

Indiana Dept Of Revenue Inrevenue Twitter

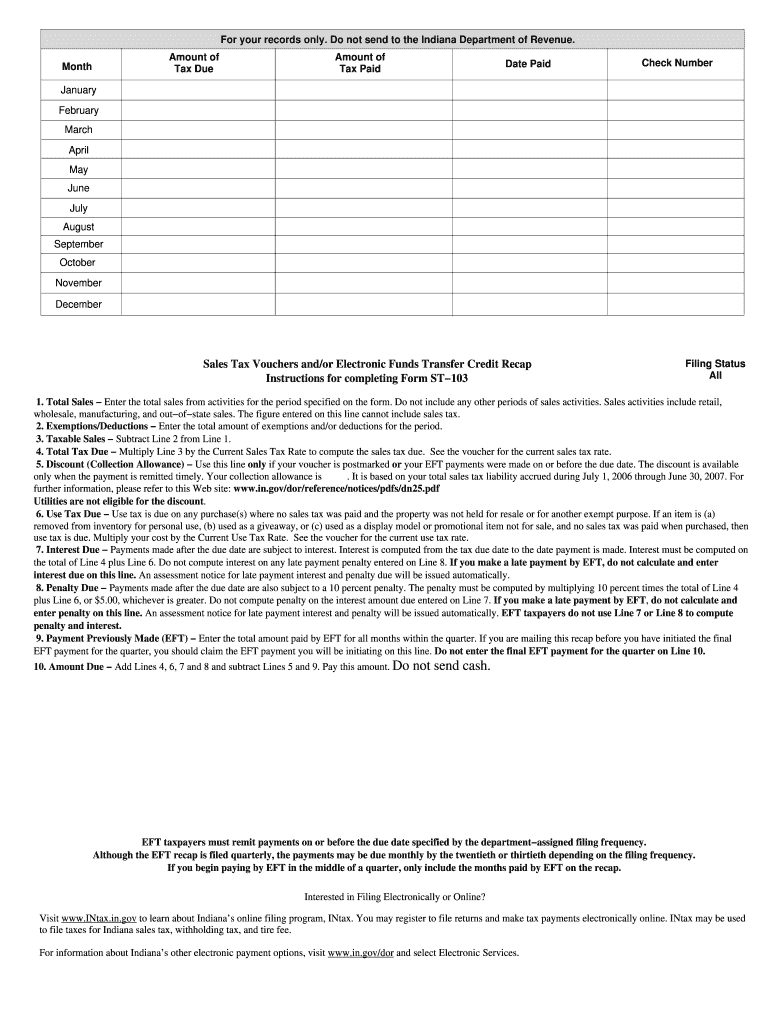

In St 103 Instructions 2007 2022 Fill Out Tax Template Online Us Legal Forms

Fillable Online Record Of Estimated Tax Payments For Indiana Corporate Adjusted Gross Income Tax For Calendar Year 2008 Or Fiscal Year Beginning In 2008 And Ending In 2009 Fax Email Print Pdffiller

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller